-

PERSONAL

-

BUSINESS

BORROWING

INSURANCE

-

ABOUT

WHO WE ARE

IN OUR COMMUNITY

CYBER SECURITY & FRAUD HUB

For quick and easy access to your bank statements, please log in to Online Banking. To sign up, please CONTACT US.

CANADA DAY!

We will be closed Tuesday, July 1st, reopening Wednesday, July 2nd at 9:30am

Your first mortgage or renew your mortgage with us.

Rates as low as 4.10%!

Let's Talk.

$34,555

Donated in 2024 to community organizations and bursaries for local students.

Term Deposits

Current Term Special as high as 3.00%

$504,214

In patronage and dividends given back to our members and community for 2024.

__________________________________

THE CREDIT UNION DIFFERENCE

INCREASED ONLINE SECURITY

IS HERE!

2FA (2SV) - Add an extra layer of security to your accounts.

Sign in and sign up today!

Mandatory registration begins February 26, 2025.

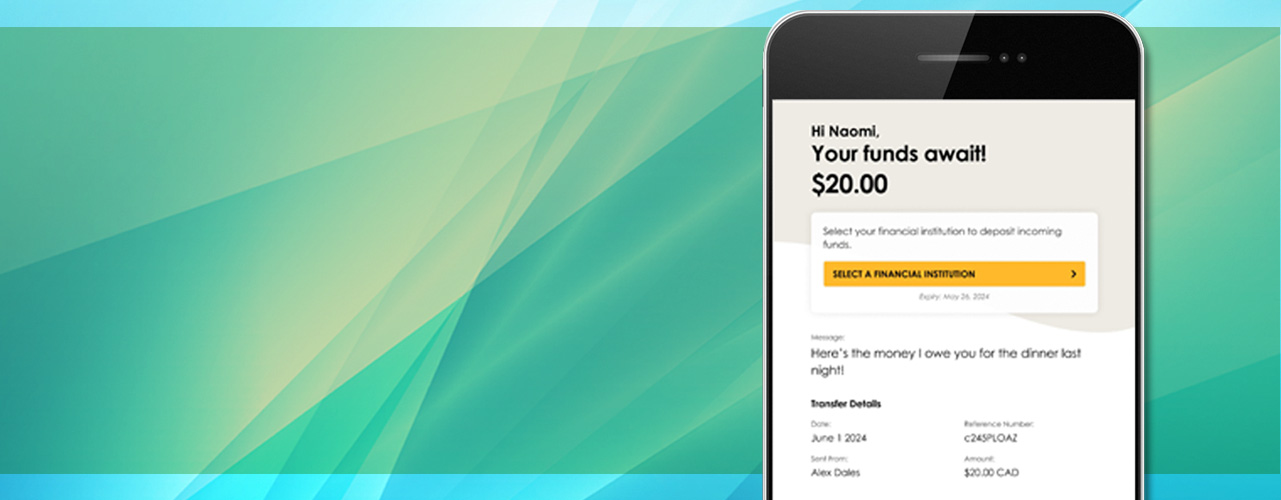

Interac e-Transfer notifications have been updated to provide you with a better experience.

Your Interac e-transfer notifications look different, but they still have the same security and convenience.

View our list of 2025 holiday closure dates, and important federal deposit dates here.

What would you like to do today?

2025 SPRING Mortgage Campaign

Take advantage of our mortgage rates to buy the home of your dreams!

Lock yours in by calling us at 428-5351.

Set your kids up for financial success

Our Kirby KangerooTM Club and NChargeTM Accounts are designed to help kids and teens up to age 18 learn about saving, money management and more.

What’s new at CDCU

FRAUD ALERT - SCAMS IN THE AREA!

We’re asking members to be vigilant when it involves their online banking, as well as calls and emails claiming to be from us.

If in doubt, hang up immediately, and call us directly at 250-428-5351 !

BE ON THE LOOK-OUT FOR SCAMMERS TRYING TO CONTACT YOU!

Giving out personal or financial information may cause you to suffer a financial loss.

REVIEW OUR SECURITY TIPS BELOW

.png)

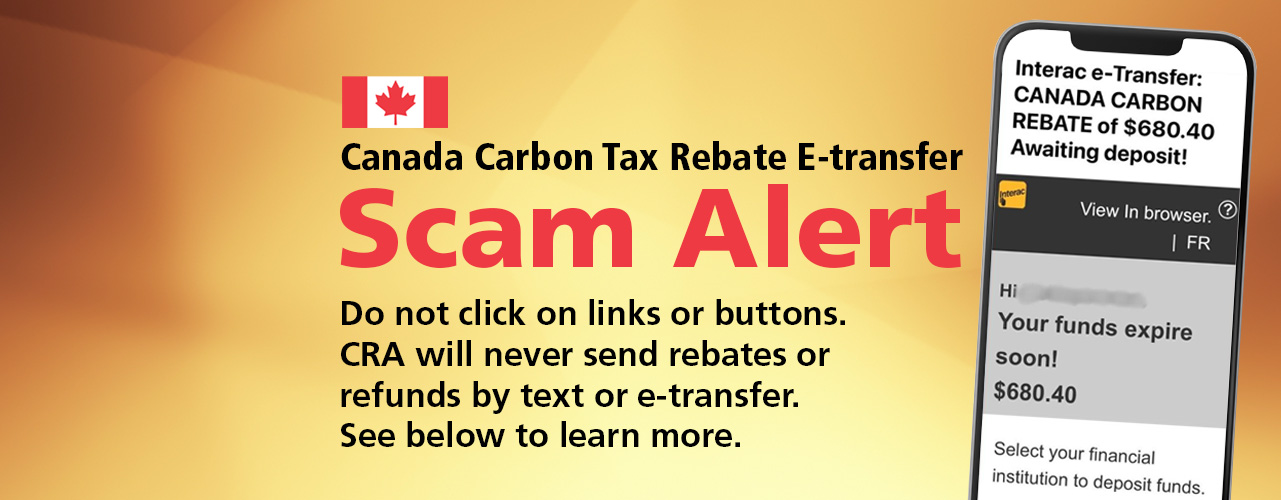

CANADA CARBON TAX REBATE SCAM ALERT!

Canadian Police Services are alerting the public about a Canada Carbon Tax Rebate e-Transfer scam currently circulating via email and text message.

Please remember, the Canada Revenue Agency (CRA) will never send rebates or refunds by e-Transfer or text message.

Ways to stay safe:

- Do not click on any buttons or links.

- Do not reply to the message.

- Do not share any personal or financial information.

Keep updated with the CRA and their latest Scam Alerts HERE.

If you think you have fallen victim to this scam, please contact us immediately!

MOBILE BANKING UPDATE

Please reach out to us for any questions. Thank you!

To enable auto-update on Google Play:

1. Open the Google Play Store App

2. At the top right, tap your profile icon

3. Tap Settings > Network Preferences

4. Select an option

Please note that our Mobile Banking Apps update frequently. We are constantly working on improving your online banking experience and adding new features and security measures. To keep up to date with these new features, be sure to update whenever there is one available.